Guest

Host

Related Topics

Other segments from the episode on October 2, 2003

Transcript

DATE October 2, 2003 ACCOUNT NUMBER N/A

TIME 12:00 Noon-1:00 PM AUDIENCE N/A

NETWORK NPR

PROGRAM Fresh Air

Interview: Grover Norquist, president of Americans for Tax

Reform, discusses the Bush administration's tax plans

TERRY GROSS, host:

This is FRESH AIR. I'm Terry Gross.

Last month, I interviewed Paul Krugman, a columnist for The New York Times and

an economics professor at Princeton University. Krugman opposes President

Bush's tax cuts and believes that his economic policies could send us into a

spiral of fiscal collapse. Krugman said that behind Bush's economic policies

is a plan to deprive the government of revenue so that it's forced to

dismantle most of the federal system that's been built up since the 1930s.

Krugman cited Grover Norquist as being one of the leading architects of the

current administration's policies. We wanted to hear Grover Norquist's point

of view, so we invited him to be our guest today on FRESH AIR. He's the

president of Americans for Tax Reform. He also organizes other conservative

groups under the umbrella of the American Conservative Union. He founded the

K Street Project, whose goal is to encourage corporate CEOs to hire lobbyists

with Republican affiliations. Norquist also helped write the Republicans'

1994 Contract with America.

For the past 10 years, he's presided over invitation-only off-the-record

Wednesday meetings where a group of influential conservative activists,

lobbyists, journalists, scholars and politicians gather to discuss the

political issues of the day. An article in USA Today referred to Norquist's

office as the `incubator for Bush's political strategy.' I asked Grover

Norquist if he directly advises the president about tax cuts.

Mr. GROVER NORQUIST (President, Americans for Tax Reform): Well, actually I

started working with the president a couple years before the election. I

think he's fairly clear in my view and the view of the American people and the

taxpayer movement that they'd like lower taxes, and my consistent advice is

tax rates should be lower, taxes should be simpler, clearer, more visible and

that we should eliminate the double taxation of income, double and triple.

Right now we tax it when you earn it. We tax it when you invest it. We tax

it if it's invested inside a corporation. We tax it when it comes out as a

dividend. If you're stupid enough to die, they steal half again. So we want

to get the government down to taking one bite of the apple.

GROSS: Now the Bush tax cuts would cost us about $1.1 trillion over the next

10 years, and we're going to be hundreds of billions of dollars in debt. At

the same time, the president wants $87 billion to rebuild Iraq and

Afghanistan. Do you think we're in a tough spot, needing a lot of money, to

rebuild those two countries at the same time that we're cutting taxes?

Mr. NORQUIST: Well, there's a very interesting use of the word `we.' Every

time you use the word `we,' you meant the government, and I tend to use the

word `we' to mean the American people and to speak of the government as the

government. So when the government doesn't take as much of your money next

year as it did last year, we have more money. The government has a lower tax

rate, and depending on economic growth, may have more or less money, but we,

the people, have more money. So it is a good thing for us to have lower

taxes.

Now the government spends about 20 percent of--the federal government,

national government spends 20 percent of the Gross Domestic Product of the

country. Twenty percent of everything created in this country is taken by

force by the government and spent. That's too high. It is historically too

high, and that number needs to be reduced and we need to both reduce the total

taxes on us, the American people, and we need to reduce the spending by them,

the government.

GROSS: Well, you know, you're talking about `we.' Should we use the word

`we' to describe our government while, you know, the government has invaded

Iraq and fought a war in Afghanistan in our names and...

Mr. NORQUIST: Yeah, that's fair enough, in our names, but that's not the same

thing. I wasn't over there. I didn't do it. We didn't do it. The US

government, the US Army did it.

GROSS: But they're using your money to do it.

Mr. NORQUIST: That's true. That is true. Yeah...

GROSS: And...

Mr. NORQUIST: ...I just think it's interesting that when somebody says, `This

tax cut costs us,' where are they standing? They're standing in the shoes of

the state, not the shoes of the citizenry. Tax cuts do not cost us. Tax cuts

benefit us. Tax cuts may, depending on how they're structured, result in the

government having fewer resources.

GROSS: Now critics of the president's tax cuts say that it's helping the

wealthy a whole lot more than it's helping the middle class or people in the

lower middle class. What's your argument in support of those tax cuts?

Mr. NORQUIST: Yeah. I'm actually old enough to be rather tired of the class

warfare argument, and it's nonsense on a number of scales. First of all, when

you talk about rich and poor people in America, you have to ask, unlike, say,

Britain of 200 years ago or Saudi Arabia today, rich and poor are not things

that you tag somebody and they live with all their life. There's some new

data from the Census Bureau. Of all those people who were in poverty between

1996 and 1999, that four-year period, 34 percent left poverty within four

months of entering it. So a third of poor people during that period were only

poor for four months or less. Eighty percent of the people who were poor

during that period were poor for less than a year. Somebody loses a job,

something goes wrong, they're poor, then they get a job, and they're not poor

again. Of all the people who were poor during the entire period of '96 to

'99, one out of 17 people who were ever poor were poor for the whole period.

Go to rich people. This is one of the games that the left used to play when

we'd cut the capital gains tax. They'd say, `Only rich people or mostly rich

people pay capital gains taxes, like when you sell your house.' Well, guess

what? If you make $30,000 a year and you sell your $100,000 house one year

and you go back to making $30,000 a year, during the year in which you paid

the capital gains tax on the house, you show up as having made $100,000, and

then they say, `Only people who make $100,000 get a capital gains tax.' It's

just nonsense.

People get poorer, they get rich. Of the families in the lowest income

quintile, the lowest fifth, in 1988, for instance, half of them moved to a

higher quintile in the next 10 years. So they moved from the bottom 20 to the

between 20 and 40 or higher. Forty-seven percent in the highest 20 percent

dropped to a lower one within 10 years. There's a tremendous amount of

economic mobility, and so when people try and use the kind of rhetoric that

might have been clever in East Germany in 1957, they miss that they're talking

to the American people.

GROSS: OK. But we're talking about, for instance, the elimination of the

estate tax. The estate tax is only paid by somebody who gets over $2 million

in inheritance. So, you know, when you get out of poverty and you cross that

line which is--What is it, like, $18,000 or something that's officially

poverty line?

Mr. NORQUIST: Depends on how many kids you have. Yeah.

GROSS: Right. OK. So when you cross that, maybe you're making, like,

$20,000 or something. That's not going to help you with the estate tax. I

mean, you're talking about $2 million. That's a line people don't cross a

lot. That's--I don't think that's...

Mr. NORQUIST: Yeah, the good news about the move to abolish the death tax,

the tax where they come and look at how much money you've got when you die,

how much gold is in your teeth and they want half of it, is that--you're

right, there's an exemption for--I don't know--maybe a million dollars now,

and it's scheduled to go up a little bit. However, 70 percent of the American

people want to abolish that tax. Congress, the House and Senate, have three

times voted to abolish it. The president supports abolishing it, so that tax

is going to be abolished. I think it speaks very much to the health of the

nation that 70-plus percent of Americans want to abolish the death tax,

because they see it as fundamentally unjust. The argument that some who

played at the politics of hate and envy and class division will say, `Yes,

well, that's only 2 percent,' or as people get richer 5 percent in the near

future of Americans likely to have to pay that tax. I mean, that's the

morality of the Holocaust. `Well, it's only a small percentage,' you know.

`I mean, it's not you, it's somebody else.' And this country, people who may

not make earning a lot of money the centerpiece of their lives, they may have

other things to focus on, they just say it's not just. If you've paid taxes

on your income once, the government should leave you alone. Shouldn't come

back and try and tax you again.

GROSS: Excuse me. Excuse me one second. Did you just...

Mr. NORQUIST: Yeah?

GROSS: ...compare the estate tax with the Holocaust?

Mr. NORQUIST: No, the morality that says it's OK to do something to do a

group because they're a small percentage of the population is the morality

that says that the Holocaust is OK because they didn't target everybody, just

a small percentage. What are you worried about? It's not you. It's not you.

It's them. And arguing that it's OK to loot some group because it's them, or

kill some group because it's them and because it's a small number, that has no

place in a democratic society that treats people equally. The government's

going to do something to or for us, it should treat us all equally. And the

argument that Bill Clinton used when he wanted to raise taxes in '93 was `I'm

only going to tax the top 2 percent. So this doesn't affect the rest of you.

I'm only going to get some of these guys; not you, others.'

The challenge there when people use that rhetoric in addition to the fact that

I think it's immoral to separate the society by--when South Africa divided

people by race, that was wrong. When East Germany divided them by income and

class, that was wrong. East Germany was not an improvement over South Africa.

Dividing people so that you can mug them one at a time is a bad thing to do.

Whether you're doing it on racial grounds, religious grounds, or whether you

work on Saturdays or not grounds, on economic grounds.

GROSS: So you see taxes as being the way they are now terrible discrimination

against the wealthy comparable to the kind of discrimination of, say, the

Holocaust?

Mr. NORQUIST: Well, what you pick--you can use different rhetoric or

different points for different purposes, and I would argue that those who say,

`Don't let this bother you; I'm only doing it'--I, the government. The

government is only doing it to a small percentage of the population. That is

very wrong. And it's immoral. They should treat everybody the same. They

shouldn't be shooting anyone, and they shouldn't be taking half of anybody's

income or wealth when they die.

GROSS: My guest is Grover Norquist, president of Americans for Tax Reform.

More after a break. This is FRESH AIR.

(Soundbite of music)

GROSS: My guest is Grover Norquist, president of Americans for Tax Reform.

When all the Bush tax cuts go through and we have, you know, billions and

billions and billions of dollars less for the government to work with, some...

Mr. NORQUIST: Trillions, yes.

GROSS: Trillions, yes. Some tough choices will have to be made. What are

you recommending that the president cut? What kind of operations and services

and so on do you think should go?

Mr. NORQUIST: Well, I think what you have to look at in some cases is whether

something that's being run by the government now needs to always be run by the

government. This administration has proposed that we actually enact the law

which has been there since the '50s, which is if something is being done by a

government employee at the national level, and it's actually available to be

done through the Yellow Pages, like people cutting grass, or serving food at a

restaurant, it's not an inherently governmental task. The guys who cut the

grass at the Pentagon don't have to be soldiers. They could be contractors

who cut grass at the bank when they're not cutting grass at the Pentagon.

There are 850,000 present government positions, government jobs, full-time

jobs, for the federal government, which is almost half of all federal civilian

employment, that the government itself says is not inherently governmental.

We don't want the private sector being a judge necessarily or executing people

or running or being in the military--being a soldier. When we have begun to

competitively source those jobs, let's say, here's a task that the government

does right now, we're going to let the private sector bid on it, and then

either the present government workers reorganize themselves, come up with a

way to do it less expensively and they win the contract, which often happens,

or the private sector contractor gets the job. It has resulted in a 30

percent reduction in the cost of providing that service. Were we to

competitively source all of the available jobs that the government itself

admits don't have to be done by the government, that would save $25 billion

every year from now out, $25 billion. That's a start, and that's not a

reduction in service. That would be an improvement in services.

GROSS: The reverse way of looking at that would be that a lot of people

who--a lot of workers who have federal positions wouldn't have federal

positions and they'd be getting paid less. So it's potentially another

example of how working people end up on the downside of the tax cuts because

now you're taking jobs, you're outsourcing them, those people will be paid

less money, and these are also the people who aren't getting a lot of money

from the tax cuts.

Mr. NORQUIST: Well, if putting government people on government payrolls made

a society or a people wealthy, the Soviet Union, East Germany and Romania

would have been very wealthy societies. In point of fact, putting people on

government payrolls doesn't make the society or the people involved better off.

What these competitively sourcing jobs are doing is taking a project and

deciding to do it and bid it so different people come and say, `We could do

that in different ways.' We have the highest income in the United States per

capita, and the most vibrant free market and private sector. These two go

together. It's not as if something isn't done by the government that it's

being done by someone in the private sector getting paid less. It's probably

a bunch of people getting paid more who don't have the same work rules and who

don't have some of the anti-productivity rules that some of the civil service

people put in in terms of their inability to be more flexible.

GROSS: You've said that over the next 25 years you'd like to see the

government shrink by half.

Mr. NORQUIST: Yes.

GROSS: What would happen in your plan to public schools, the police,

firefighters, highways and homeland security?

Mr. NORQUIST: Certainly. I would like to see--and the goal of the center

right coalition in America today is to drop the cost of government, federal,

state and local together, in half, with several measures: one, total spending

as a percentage of the economy. Right now, government spending is about 30,

32 percent of the economy. I want to take that down to 16 percent of the

economy over 25 years. How do you do that? You mentioned roads. Roads built

by the federal government cost 30 percent more than they have to because there

is a racist law which was passed in the 1930s called the Davis-Bacon Act. It

was designed--and the people on the floor of the House and Senate who passed

it said clearly it was designed to keep black people out of the construction

industry because blacks were moving up from the South working on highways, and

they only wanted white guys to have those jobs. This Davis-Bacon Act, which

requires, quote, unquote, "prevailing wages," meaning union wages, to be paid,

means that you can't have different companies bidding, and it bids up the cost

of building highways by about one-third.

GROSS: So what you're saying is by not paying a union wage, by lowering the

wages of those workers, we could cut more taxes.

Mr. NORQUIST: Well, you had said what services...

GROSS: Right.

Mr. NORQUIST: ...do you have to get rid of to drop the cost of government

significantly.

GROSS: Right.

Mr. NORQUIST: And my argument is you don't have to drop service. I'm not

talking about less roads. I want more roads, not less roads.

GROSS: But you're talking about lower wages. Am I reading you wrong? Just

tell me, am I reading you wrong, that--paying workers less...

Mr. NORQUIST: Well, not necessarily lower wages...

GROSS: Yeah.

Mr. NORQUIST: ...because over the course of a year, you're talking about

people having full-time jobs for the whole year. What you do with the

Davis-Bacon Act is you spike people's income for a short period, and then they

go unemployed for a longer period. So I would argue that you're talking about

having a wealthier and more successful set of employees in non-union

construction, which is why most construction people are non-union by choice.

And so the Davis-Bacon Act is an example of a law. When you compare

government education and independent education in this country, independent

education costs about half as much and provides a better education than

government education, on average.

GROSS: Do you think we should do away with public schools?

Mr. NORQUIST: No. I think what we should do is allow those tax dollars which

flow to education to go to parents and through children, not through

bureaucracies. Right now, you know, the bureaucracy of the Catholic school

system in New York is a fraction per pupil of the government-run bureaucracy.

I'm speaking to you from Washington, DC. We have a very extensive and very

expensive bureaucracy and a very lousy school system that does not educate

children. Less than half of the money gets anywhere close to educating

children; the rest goes to the bureaucracy. And we ought to be in the

business of saying no money to expand the bureaucracy; money should flow with

students. This, in some states and cities, is done through vouchers or

scholarships. And you say, `Look, if our city or state is going to spend

5,000 or $7,000 per kid, the money flows with the child.' And that's when

parents will get respect and decent treatment from the bureaucrats and the

teachers in schools.

GROSS: So you're basically talking about vouchers?

Mr. NORQUIST: Well, vouchers, scholarships. I mean, all of those would make

sure that the parents and the children are in control, rather than the

bureaucracies.

GROSS: Do you think that--you know, a lot of states in the United States are

complaining now that they're not getting the money from the federal government

that they need for homeland security. How do you propose dealing with the

issue of homeland security? And the need for that is at an all-time high, at

a time when cutting taxes is also at an all-time high.

Mr. NORQUIST: OK. It is true that some incompetent politicians at the state

and local level have argued that they're not getting as much money from the

federal government as they would like. It is probably true they're not

getting as much money from the federal government as they would like. I am

looking at a chart which shows the growth of federal grants to states in 2000,

up 5 percent, then up 10 percent in 2001, up 10 percent in 2002, and up 15

percent in 2003. I know that the politicians at the state and local level who

do not do their jobs well like to blame other people. So do four-year-olds.

We don't put up with it in four-year-olds, and we shouldn't put up with in

incompetent mayors and incompetent governors.

One of the good things about the states--and I am a Ronald Reagan federalist,

meaning I like 50 states not because they're closer to the people; that's

nonsense. I'm not any closer to my governor than I am to the president. But

there are 50 of them, and when they do something really stupid, you can move.

You can move your money. And people do move between states when states behave

badly. It's a reason people leave New York or, 20 years ago, were leaving

Massachusetts, because they were providing very bad government. Why did

people leave New York City in great numbers prior to Rudy Giuliani's change of

crime and tax policies? So it is a good thing that states compete to provide

the best government at the lowest cost. And people decide what level of

government they're willing to pay for, and they want.

GROSS: Grover Norquist is the president of Americans for Tax Reform. He'll

be back in the second half of the show. I'm Terry Gross, and this is FRESH

AIR.

(Soundbite of music)

(Announcements)

GROSS: Coming up, Paul Newman talks with us from the set of "Empire Falls,"

the movie adaptation of a Pulitzer Prize-winning novel. He plays the stage

manager in a production of "Our Town" that will be shown Sunday on CBS. And

we continue our conversation with Grover Norquist, president of Americans for

Tax Reform.

(Soundbite of music)

GROSS: This is FRESH AIR. I'm Terry Gross.

Let's get back to our interview with Grover Norquist. He's the president of

Americans For Tax Reform and a leading advocate of cutting taxes and reducing

federal spending. He also organizes other conservative groups under the

umbrella of the American Conservative Union.

With the kind of tax cuts that we're already getting and the additional tax

cuts that you would like to see, what would you recommend happen with Social

Security and Medicare?

Mr. NORQUIST: Well, Social Security--the good news is that there's an

emerging consensus in the United States that we need to do what President Bush

recommended in the last campaign, and that is to take--begin the process of

moving it from a Ponzi scheme--a pay-as-you-go scheme where you pay your

Social Security FICA taxes this week, and next week it goes to pay for

somebody who's retired and there's no savings for you; there is no account for

you; there is just debt--to one where you take your FICA tax or the equivalent

of your FICA tax and put part of it--and I would like eventually to phase in

all of it--into a 401(k) or an IRA or a personal savings account. Were we to

have started 40 years ago and said to everyone, `Your FICA taxes will go into

a personal savings account that you can retire on,' people would be retiring

with hundreds of thousands of dollars in assets, including low-income people,

and have much more resources each month because that money would have

accumulated and increased in value over time.

So the good news is that that poll's at 70 and 80 percent support, so the

tremendous level of support for making that move; and the younger you are, the

more anxious people are to make that change because they do not believe Social

Security as presently structured will provide them any decent retirement, and

they're right to not believe that.

GROSS: Well, a couple of things. First of all, I think a lot of people would

disagree that Ponzi scheme is an appropriate word for Social Security. I mean

it's true that the money you put into Social Security supports the generation

that has already retired, and then the next generation should be putting money

in that supports you, and so on. That's different than a Ponzi scheme in

which the people at the bottom never get any return.

But, you know, there is a fear on the part of the many critics of your scheme,

is that, you know, first of all, unless you have money to put into these

401(k)s, you're not going to get much back. And there was, you know, this

kind of guarantee of Social Security for working people. The stock market can

fall. You can make bad investments and end up with little or nothing in the

alternate scheme to Social Security. You're not concerned about that?

Mr. NORQUIST: I am concerned the demagogues of the left will trot that out

again. I'm less concerned because they've done it before and nobody's buying.

The idea that your money is safe because the government has it is an

interesting concept, but not one that impresses the American people. You

don't have to save money in stocks and bonds; you can do it with the bank.

And Social Security is only there for people who work anyway, and so it's not

like you get Social Security benefits for free.

If you simply take the money that was put into the FICA program on your

behalf, theoretically on your behalf and given to somebody else, if you'd

taken that money and invested it in a bond or in the stock market at any time

during the last 70 years, if you'd invested at the high point and taken out at

the low point, you'd still be better off than the government's present

program, which is a Ponzi scheme, which is they promise to invest your money

and they don't invest it, they give it to previous investors.

GROSS: Just proceeding down the line here of changes that you'd like to make,

what changes would you want to make in Medicare because of cut taxes?

Mr. NORQUIST: Well, whether you cut taxes or not cut taxes, you have to

reform Medicare. It's going bankrupt. And Medicare, with no changes, goes

bankrupt within the next 20 years. It's in worse shape than Social Security.

It needs to be reformed, not because of any tax cuts. You can't erase taxes

fast enough to save the present system. It needs to be reformed because it

has got financial problems. I would suggest that we give people more options

rather than have one-size-fits-all situations, which is what Medicare does.

The federal government runs a program for its employees, which gives them

quite a number of different options: medical savings accounts, you know,

different kinds of ways to prepay or insure for health care.

At bottom, monopolies do a poor job of providing services to people at a

reasonable cost. That is true whether it's the steel mill that has a

government monopoly or whether it's a government retirement program or

government health-care program. Monopolies don't work well.

GROSS: So are you talking about doing away with Medicare and creating a

different alternative?

Mr. NORQUIST: Well, I wouldn't--you can play semantic games and say if you

reform it and give people more options, you've done away with it, I'd say

leave the present program there for anyone who wants it and have alternative

options if people would prefer. All of the people who want to reform Social

Security say, `Look, leave the present system there for anyone who is

uncomfortable changing anything.' In any society there are some people that

just want to stay with the status quo, even if the status quo makes them poor,

because they just hate risk. So if you want to stay with Social Security, you

want to stay with Medicare, do so, but there should be other options that

would allow people medical savings accounts, which are terribly helpful, very

important. I think that people who don't want people to have options because

if they had options they wouldn't take the government monopoly's program are

not acting in the best interests of the people that they claim to represent.

GROSS: If you're just joining us, my guest is Grover Norquist. He's the

president of Americans For Tax Reform, and he has worked very closely with

President Bush in formulating the tax-cut plan and he's one of the strongest

advocates in America for major tax cuts.

Are there any services that you think taxes should support? Do you think that

the American public should be taxed to support any of the services that we

have now?

Mr. NORQUIST: Well, at the national level, we spend right now 3 1/2 percent

of GDP on defense, 3 1/2 percent of GDP. All federal spending, national

spending, national government spending, is 20 percent of the economy. I think

national defense is very important. I think 3 1/2 percent's probably a little

high, but 2 percent--we could run the planet for spending 2 percent of GDP if

we spent it competently. We're doing pretty well at 3 percent and we ought to

get a little more efficient and effective there. So yeah, I think we can rein

in spending. I think we ought to have strong economic growth over the next

several years in the...

GROSS: But in addition to defense, are there any services that the government

should supply?

Mr. NORQUIST: Oh, certainly, yes. Protecting property rights, making sure

that bad guys--you know, if they steal things or shoot somebody that they get

arrested and prosecuted. Now I don't think that the government has to build

the prisons. When you have privately built prisons, they cost half as much as

when the government builds them. There are privately run prisons in this

country, too, for a lot of prisoners. So some stuff the government does can

be contracted out. There are half a million government police in the country

and one million private-sector guards in the country. So in some senses

police protection is already two-thirds privatized. I do think a lot of

arrest powers need to be in the hands of government policemen.

So, yeah, I mean, there are a fair number of things the government can and

should do. They should run national defense, they should run a police force

at the state and local level, and courts to protect property rights. I mean,

the reason we're rich isn't that we live in America and it isn't that we're

white or Protestant or Western or anything like that. It's because we respect

property rights and we have the rule of law. And people from all over the

world, all religions, all faiths, all ethnic backgrounds, thrive under those

rules. And in other countries where they don't have those rules, they're

poor. So it's very important that the government protect property rights,

freedom of contract, that sort of thing.

GROSS: Your group, Americans For Tax Reform, has constructed something called

the Taxpayer Protection Pledge...

Mr. NORQUIST: Yes.

GROSS: ...which you administer to political candidates, and the pledge reads

`I pledge to the taxpayers that I will oppose and vote against any and all

efforts to increases taxes.' Is cutting taxes almost like a religion to you?

Mr. NORQUIST: No. It's an important political principle, and politics and

religion are two different things and ought to be. But we have 217 members of

the US House who've signed that pledge never to raise taxes, 42 senators, one

president, 1,200-plus state legislators and eight governors, and my goal is to

get a lot more of the state legislators and a lot more of the governors. For

starters, the government ought not to be taking more money from the American

people, because in every city, every state at the national level, it is today

spending too much, taxing too much and wasting too much.

GROSS: You are very anti-government in a lot of ways. I mean, although

you're very close to people in government and have helped many of them get

elected, you at the same time seem very alienated and even opposed to a lot of

facets of government. I'm wondering, what were some of the key incidents that

shaped you in that position?

Mr. NORQUIST: Well, I'm in favor of a healthy and limited government. I

mean, if you're looking at somebody with lung cancer and, say, you cut the

cancer out, that doesn't make you anti-lung. I want a government that

protects property rights and leaves people alone and says foreigners can't

come mess with us and criminals shouldn't and can't come mess with us. Those

are legitimate functions of a government. Beyond that, the government becomes

abusive, it becomes tyrannical. And I guess there are some--but, you know,

even completely tyrannical governments provide some services, but that doesn't

justify the tyranny.

GROSS: When Paul Krugman was on FRESH AIR last month, The New York Times

economics columnist, he described the Bush administration as revolutionaries

because of all the things they wanted to change in America, including the

cutting of taxes and the cutting of many government programs. Do you think of

yourself as a revolutionary?

Mr. NORQUIST: Well, the good thing about being an American conservative is

that you can be both traditionalist and revolutionary, because European

conservatives are people who think that everybody on this side of the river is

a good guy and everybody on that side of the river is a bad guy, or that my

religion's better than your religion or we like the king or something stupid

like that. American conservativism harkens back to our American tradition,

which is one of armed resistance in central government. It is a very

revolutionary idea. The Declaration of Independence and the Constitution were

and are revolutionary documents in the course of a human history, the idea

that people should be free and independent and autonomous, to the point where

they should be armed, and that the government ought not to be pushing people

around and has no divine right to mess with you and shove you around and steal

your money and steal your property and tell you what to do and what church or

synagogue or mosque to go to. These are very revolutionary ideas.

GROSS: OK. Thank you so much for talking with us.

Mr. NORQUIST: Take it easy.

GROSS: Grover Norquist is the president of Americans For Tax Reform.

Coming up, Paul Newman. This is FRESH AIR.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

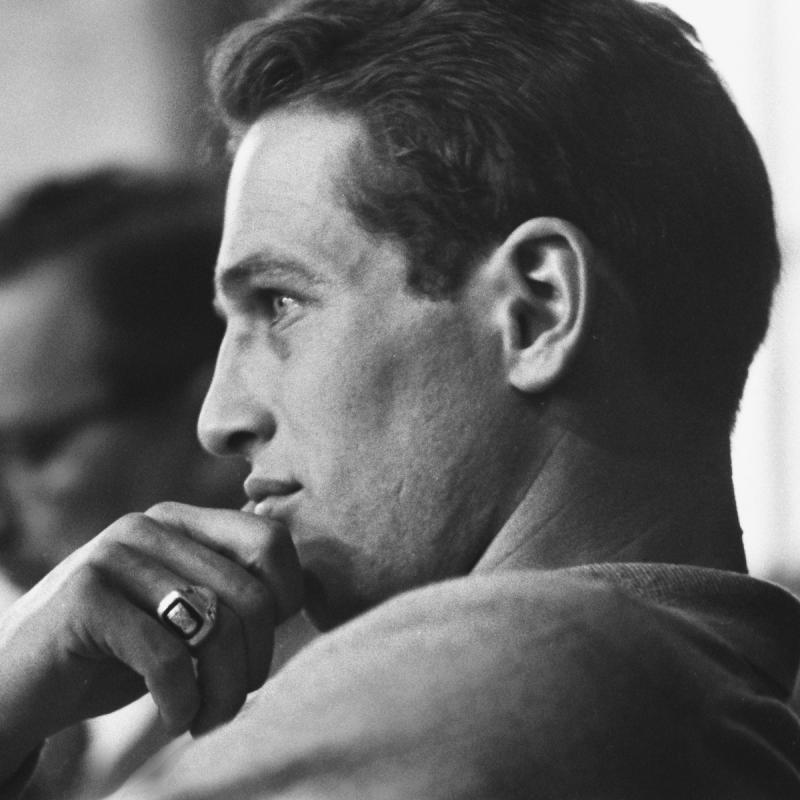

Interview: Paul Newman discusses his recent acting projects and

his career

TERRY GROSS, host:

Paul Newman stars in a production of Thornton Wilder's 1938 play "Our Town"

that will be shown Sunday night on many PBS stations. The production

originated at the Westport Country Playhouse in Connecticut. Newman is on the

company's advisory board and his wife, Joanne Woodward, is the artistic

director. The Westport production moved to Broadway, where Newman was

nominated for a Tony. "Our Town" marked Newman's return to the stage after 40

years. But it wasn't the first time he performed in the play. He starred

with Frank Sinatra in a 1955 musical adaptation for television. Newman is

currently in Maine on the set of the film "Empire Falls," an adaptation of the

Pulitzer Prize-winning novel. During a short break yesterday he spoke to us

from his trailer.

Let's start with a clip of "Our Town," which is set in the small New Hampshire

town of Grover's Corners in the early 1900s. As the stage manager, Newman

narrates the story. Here he's telling us that a new bank is being built in

the town and the community is discussing what to put in the cornerstone for

people to dig up a thousand years later.

(Soundbite of "Our Town")

Mr. PAUL NEWMAN: Of course, we are putting in a copy of the Grover's Corners

Sentinel and The New York Times, and we are interested in that because some

scientific fellas have found a way of painting all that printed matter with a

glue, a kind of a silicon glue. They could keep for a thousand, 2,000 years.

Of course, we are putting in a copy of the Constitution of the United States

of America and the Bible and some of Shakespeare's plays. What do you say?

What do you think? You know, Babylon had two million people in it, and all we

know about them is the names of some kings, wheat contracts, the sale of

slaves, and yet, every night, family'd sit down to supper, a father'd come

home from work, smoke would go up the chimney, same as here. And even in Rome

and Greece, all we know about the real life of those people is what we've been

able to piece together from some of the hokey poems and the comedies that they

wrote for the theater back then.

So I'm going to have a copy of this play put in that cornerstone so that

people a thousand years from now will know a few simple facts about us, more

than the Treaty of Versailles, the Lindbergh flight, so that people a thousand

years from now will say this: `This is the way we were. In the provinces

north of New York at the beginning of the 20th century, this is the way we

were in our growing up, in our marrying, in our living and in our dying.'

GROSS: I asked Paul Newman what "Our Town" means to him.

Mr. NEWMAN: Actually, the relevance of this play was brought more closely

into perspective by a racing driver who left our open-wheel team with cars

that had 900 horsepower and weighed about 1,600 pounds to drive stock cars

that were 3,500 pounds and 750 horsepower. And when he did his first test, I

called him and I said, `How was it?' and he said, `It was blissful.' I said,

`What?' He said, `Driving those tanks?' And he said, `Yes. The speeds are

human.' And the speeds that we saw in terms of the acceleration of change, the

speed at which an idea can exist for a certain length of time, and all that is

so abbreviated and compressed now that it's very difficult for the human

psyche to even stay with it, let alone ahead of it. And so that was the

relevance for me to the play, is that people had time to just evaluate what

they were doing, they had time to smell the flowers, to do all kinds of things

that we're so embattled about and don't even have time to turn around and blow

our noses. So at any rate, that's what the play meant to me.

GROSS: Now you said you hadn't been on the stage in about 40 years. What's

it like to be on the stage again after, you know, being so used to acting in

movies?

Mr. NEWMAN: Well, my feet sweat a lot, my hands sweat a lot.

GROSS: Because of the lights or nerves?

Mr. NEWMAN: No, just nerves, really, and a certain kind of unsteadiness, but

I don't know that I actually really got comfortable with it until maybe a

month before we closed.

GROSS: Now you're speaking to us from the set of "Empire Falls," which is the

movie adaptation of the Pulitzer Prize-winning novel by Richard Russo. You

were also in the movie adaptation of his novel "Nobody's Fool." What do you

find so interesting about that series of books, which is set in

post-industrial small towns that have lost a lot of jobs?

Mr. NEWMAN: Well, he has an incredible ear for human conversation, and he has

a great eye for character development. And it's just a real pleasure to work

with that language and with the humanity that he has in the scenes. And I

hope he does another one and I ain't too old to do it for him.

GROSS: Do you mind if I ask you about Elia Kazan? You studied with him at

The Actors' Studio, you know, at the very start of your career. Any

reflections you'd like to share about him?

Mr. NEWMAN: Well, I never really saw Kazan at work. I did a screen test for

him, actually, for "East of Eden," but I never had a chance to actually work

with him.

GROSS: Was that in the James Dean part?

Mr. NEWMAN: Yes.

GROSS: Oh. Now wasn't James Dean a classmate of yours at The Actors' Studio?

Mr. NEWMAN: We were all at The Actors' Studio in those days. That was the

early '50s, '60s.

GROSS: Well, you know, when you were in The Actors' Studio with people like

Brando and James Dean, did you feel like you were a part of a generation that

was going to bring something new to acting?

Mr. NEWMAN: Well, they did bring something new to acting, but it was also a

new time of experimentation in play-writing. The social dramas of the 1930s

had been pretty much exhausted through the group theater and we were beginning

on the era of Freud and what we used to call the kitchen drama, which is

`Mommy never kissed me, which is why I'm slitting your throat today.'

GROSS: So, I mean, was it exciting for you to feel like you were a part of

something new?

Mr. NEWMAN: Well, I don't know at the time that you really know that you're

part of something new. You just know that you're part of something that's

really exciting, and I certainly did feel that. Although I must say, I had no

idea what I was doing until maybe 10 years ago.

GROSS: Why do you say that? I mean, no one will agree with you on that.

Mr. NEWMAN: Well, what is, is. And I take a look at all that stuff that I

did previously, this--wish I had another chance to take another crack at it.

GROSS: Is there something that you would really do different that you could

put your finger on?

Mr. NEWMAN: Less is more.

GROSS: Uh-huh.

Mr. NEWMAN: And I was always working awful hard in most of the early stuff.

GROSS: My guest is Paul Newman. He's starring in a production of "Our Town"

that will be shown on "Masterpiece Theater" Sunday night on PBS. More after a

break. This is FRESH AIR.

(Soundbite of music)

GROSS: Let's get back to our interview with Paul Newman. He's starring in a

production of "Our Town" that will be shown on PBS Sunday night.

What were some of the movies that you'd seen when you were young that made a

really big impression on you?

Mr. NEWMAN: Can't remember one.

GROSS: Really?

Mr. NEWMAN: Yes, until "Waterfront."

GROSS: What made an impression on you about that? What did...

Mr. NEWMAN: Just the grittiness of it and the realism and the spontaneity of

it, reality of it.

GROSS: And was that something that you felt you were already doing or that

you wanted to try to do?

Mr. NEWMAN: Well, I was pretty much as oratorical actor up until then, from

the old school, 1920s, early Barrymore, stuff like that. Go back and see "The

Silver Chalice." That was really wreckage.

GROSS: As your early biblical epic.

Mr. NEWMAN: Pretty much, yes.

GROSS: Now the movie that you're shooting now, "Empire Falls," is set in a

small town, and, of course, "Our Town" is set in a small town but about 100

years ago. You grew up in a suburb, I believe, of Ohio, of Cleveland?

Mr. NEWMAN: Yes.

GROSS: Is there anything you relate to about this small town experience?

Mr. NEWMAN: Well, Shaker Heights, Ohio, is not a small town. It's very...

GROSS: No, that's a very prosperous suburb.

Mr. NEWMAN: It's very prosperous affluent suburb, and I don't think there's a

lot of relationship between the two.

GROSS: Now your father owned a sporting goods store.

Mr. NEWMAN: Yes.

GROSS: Did you have to work in the store when you were growing up?

Mr. NEWMAN: Oh, yes, I started working in the store I think when I was about

10. On the weekends, I would go down, my brother and I would both go down and

work in the stockroom.

GROSS: Did you resent having to do that?

Mr. NEWMAN: Of course not. I'd also sold Fuller Brushes.

GROSS: Oh, really. Door to door?

Mr. NEWMAN: Yeah, door to door.

GROSS: Were you a good salesman?

Mr. NEWMAN: You betcha.

GROSS: Really. What made you good?

Mr. NEWMAN: I also had a great laundry business when I was at Kenyon. I

also peddled whiskey illicitly in Seattle when we got--when the war was over.

So I've always really been a businessman, so salad dressing is no surprise.

GROSS: Right.

Mr. NEWMAN: Thanks.

GROSS: Paul Newman, thank you so much. We'll let you get back to the set.

Thank you.

Mr. NEWMAN: You're welcome.

GROSS: Paul Newman stars in the production of "Our Town" that will be shown as

part of "Masterpiece Theater's" American collection Sunday night on PBS. He

spoke to us from the set of the film "Empire Falls."

(Credits)

GROSS: I'm Terry Gross.

Transcripts are created on a rush deadline, and accuracy and availability may vary. This text may not be in its final form and may be updated or revised in the future. Please be aware that the authoritative record of Fresh Air interviews and reviews are the audio recordings of each segment.